Metrics that Matter: How Silicon Valley VCs Look at Your Company

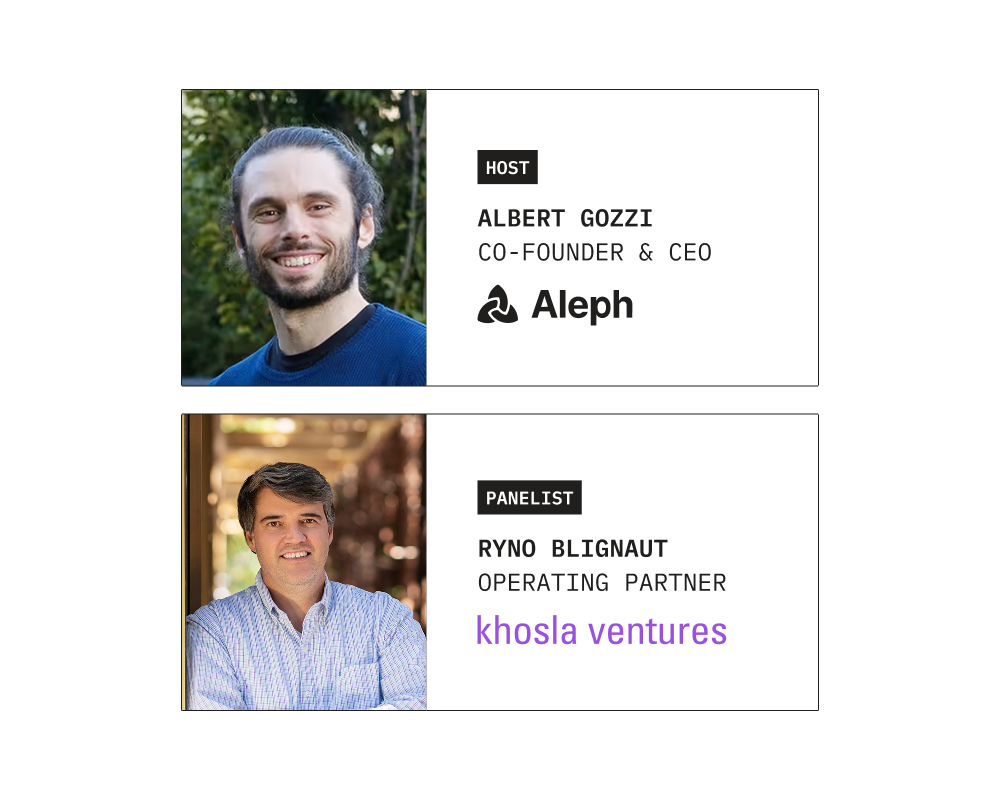

Join Aleph and Ryno Blignaut, Operating Partner at Khosla Ventures, as he breaks down the metrics top VCs actually care about—and how to use them to run and pitch your business.

Inside the journey

Unpack how top-tier investors think about business performance with Ryno Blignaut, Operating Partner at Khosla Ventures and former CFO of RH and Xoom. Drawing from decades of experience as both operator and investor, Ryno will walk through how Silicon Valley VCs truly assess startups — and how most companies get it wrong.

In this session, we’ll cut through the noise of momentum metrics like ARR and MRR, and focus on the fundamentals that actually drive strategic decisions: CAC payback, contribution margin, LTV, and real cash flow. You'll learn how to define your business through a simple, actionable financial equation and how to use it to build trust with your team, board, and investors.

Hosted by Aleph, this session is a masterclass in building financial narratives that are grounded, transparent, and investor-ready.

Join the session to learn:

- Why most “impressive” metrics fail under VC scrutiny

- How to define your business through a simple unit economics formula

- What VCs look for in CAC, payback periods, and contribution margin

- How to present your financials to boards with clarity and credibility

- The dangers of GAAP distractions like software capitalization

- The difference between cash flow storytelling and financial theater

- What Ryno wishes more startup finance leaders understood

- Plus, much more…

Watch the webinar replay!

Tune in to hear Ryno Blignaut share how top VCs evaluate startups — and how founders and finance leaders can use those same metrics to build, operate, and pitch with clarity and confidence.